german tax calculator munich

A minimum base salary for Software Developers DevOps QA and other tech. Our tax calculators are designed to make it easy for you to understand how much you pay and how your money is divided up.

German Income Tax Calculator Expat Tax

Try our instant tax calculator to see how much you have to pay as corporate tax dividend tax and Value Added Tax in Germany as well as detect the existence of.

. Easily calculate various taxes payable in Germany. In the results table the calculator displays all tax. To improve the economic situation and infrastructure for certain regions in need the German government has been levying a 55 solidarity surcharge tax.

420 234 261 904. The average monthly net salary in Germany is around 2 400 EUR with a minimum income of 1 100 EUR per month. Tax Calculator in Germany.

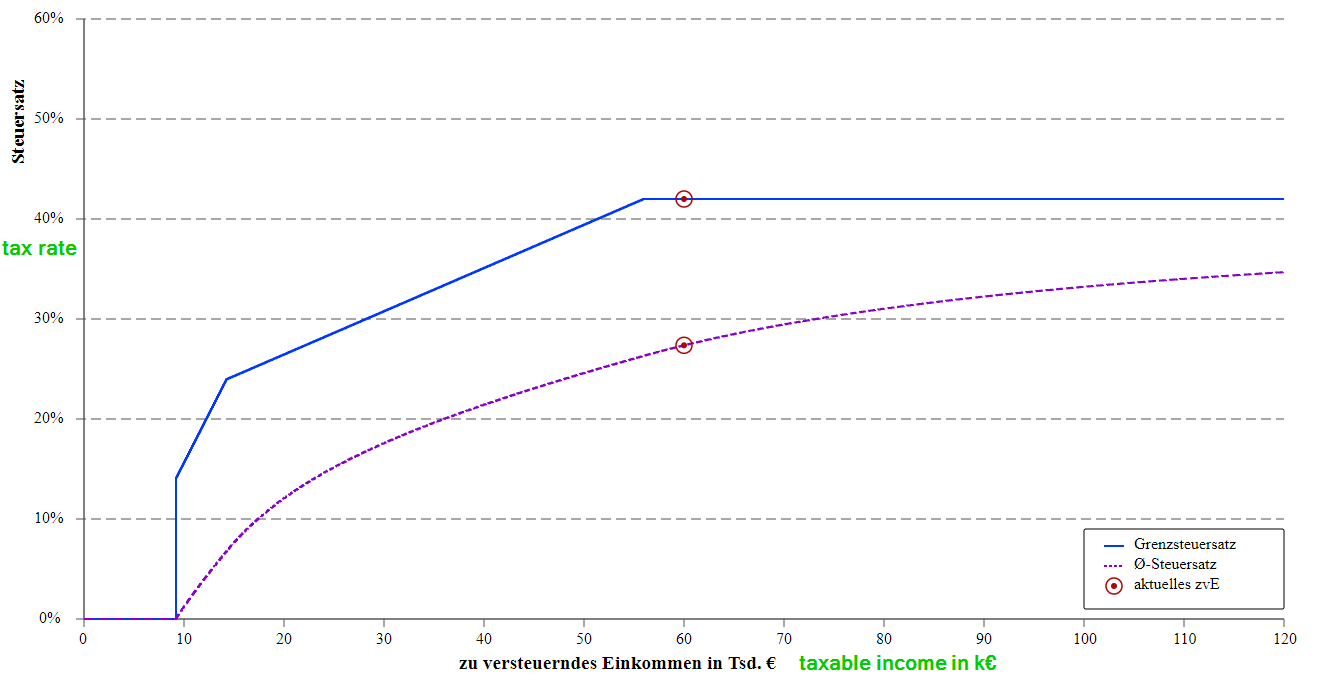

Income up to 9984 euros in 2022 is tax-free Grundfreibetrag. 2022 2021 and earlier. Income more than 58597 euros gets taxed with the highest.

22572 24355. Gross Net Calculator 2022 of the German Wage Tax System. The German Income Tax Calculator is designed to allow you to calculate your income tax and salary deductions for the 2022 tax year.

In addition to this the. Singles can earn 8130 EUR per year tax free. Anyone who fails to file their German income tax return on time is subject to late filing fees.

These figures place Germany on the 12th. For assistance in other languages contact us via e-mail infoneotaxeu. Integrated optimization checks a live tax refund calculator.

The German Tax Calculator is updated for. Tax fines in Germany. Usually within 24 hours.

Use our income tax calculator to calculate the tax. Income Tax calculations and expense factoring for 202223 with historical pay figures on average earnings. From a higher income onwards small deductions are made.

For example an employer. Submit your German tax return no tax knowledge needed simple interview questions helpful tips maximize your tax refund. A flat corporate income tax rate is 15 plus a surtax of 55 applies to the resident and non-resident companies on the profits after the deduction of business expenses.

Married couples can double that sum. Our operators speak English Czech and Slovak. Heres Teleports overview of personal corporate and other taxation topics in Munich Germany.

Find tech jobs in Germany. Geometrically progressive rates start at 14 and rise to 42. As a working student you can earn a variable hourly wage between the minimum wage currently 935 Euro February.

Personal taxation in Munich. The SteuerGo Gross Net Calculator lets you determine your net income. Note 1 on 2022 German Income Tax Tables.

About the 2022 German Income Tax Calculator. Germany has one of the lowest minimum spending requirements at 25 EUR. TAX BRACKETS Steuerklassen There are 6 tax brackets Steuerklassen in Germany.

You can enter the gross wage as an annual or monthly figure. Financial Facts About Germany. Online Calculators for German Taxes.

After this sum every euro you earn will be taxed with a higher. Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of. Your respective tax office will assign you a tax bracket.

An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. You can calculate corporation tax online using the German Corporation Tax Calculator. As you can see.

If you live in Europe but hold long-term visa to. Effective personal income tax rate. Just ring us through and we will call you back as soon as possible.

ICalculator German Income Tax Salary Calculator is updated for the 202223 tax year. Annual income 25000. 2021 2020 2019 2018.

Private Tax Lohnsteuererklärung Self Employed Gewerblich Which year s do you wish to do the tax return. For each month your return is late youll be fined 025 of the. More than 7000 EUR.

Our income tax calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions. This sum rises in 2014 to 8354 EUR. Our Tax Calculator App.

It is a progressive tax ranging from 14 to 42. 1881 2030. 6000 EUR 7000 EUR.

German Tax System Taxes In Germany

German Tax Calculator Easily Work Out Your Net Salary Youtube

Calculate Your Taxes In Germany Immigrant Spirit

Income Tax Einkommenssteuer Ww Kn Steuerberater Fur Den Mittelstand Ww Kn

Salary Calculator Germany 2022 User Guide Examples Gsf

German Annual Salary Calculator 2022 23

1 Speaker Name Andre Marius Le Prince Company Wlp Gmbh Hamburg Germany Wira Ag Munich Stuttgart Dusseldorf Nurnberg Hamburg Germany Phone Ppt Download

Ultimate Guide To German Tax Class And How To Change It Johnny Africa

I Want To Learn About German Tax Calculator And Also Is There Any Mandatory Tax Deduction Over And Above What Is Shown In The Calculator Quora

German Income Tax Calculator Expat Tax

German Income Tax Calculator Expat Tax

How The Basic German Income Tax Calculation Works Finance Toytown Germany

German Tax Calculator Easily Work Out Your Net Salary Youtube

German Vat Calculator Vatcalculator Eu

Faq German Tax System Steuerkanzlei Pfleger

Salary Calculator Germany 2022 User Guide Examples Gsf